With ChargeAfter, we have the peace of mind that our point-of-sale financing is powered by a proven platform and deep industry expertise, so we can focus on giving our customers a superb furniture buying experience.

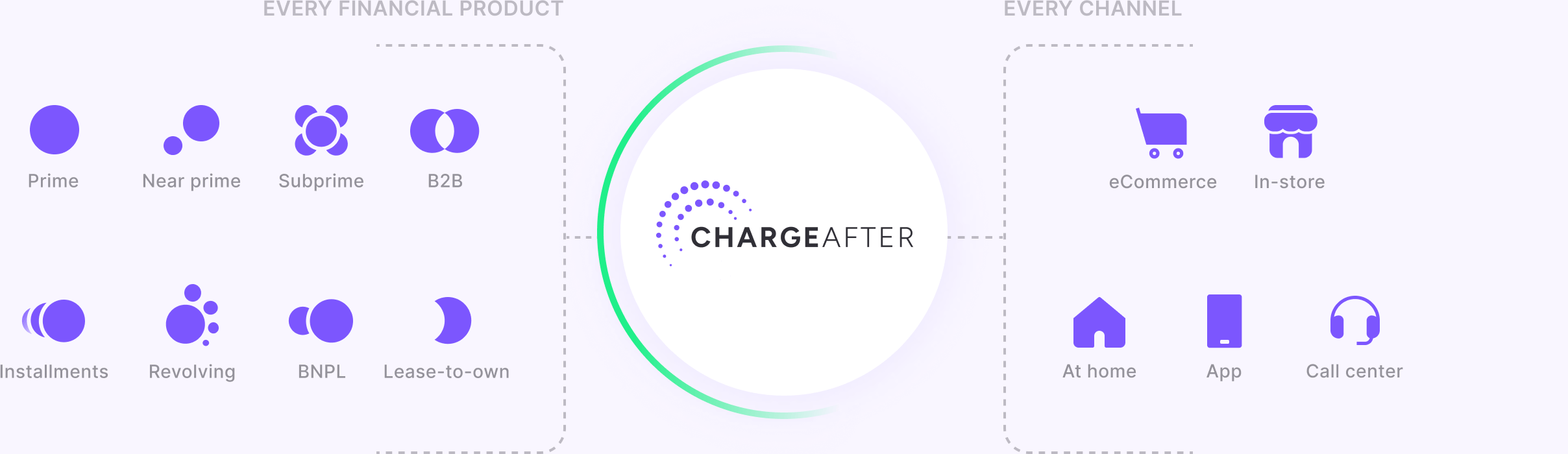

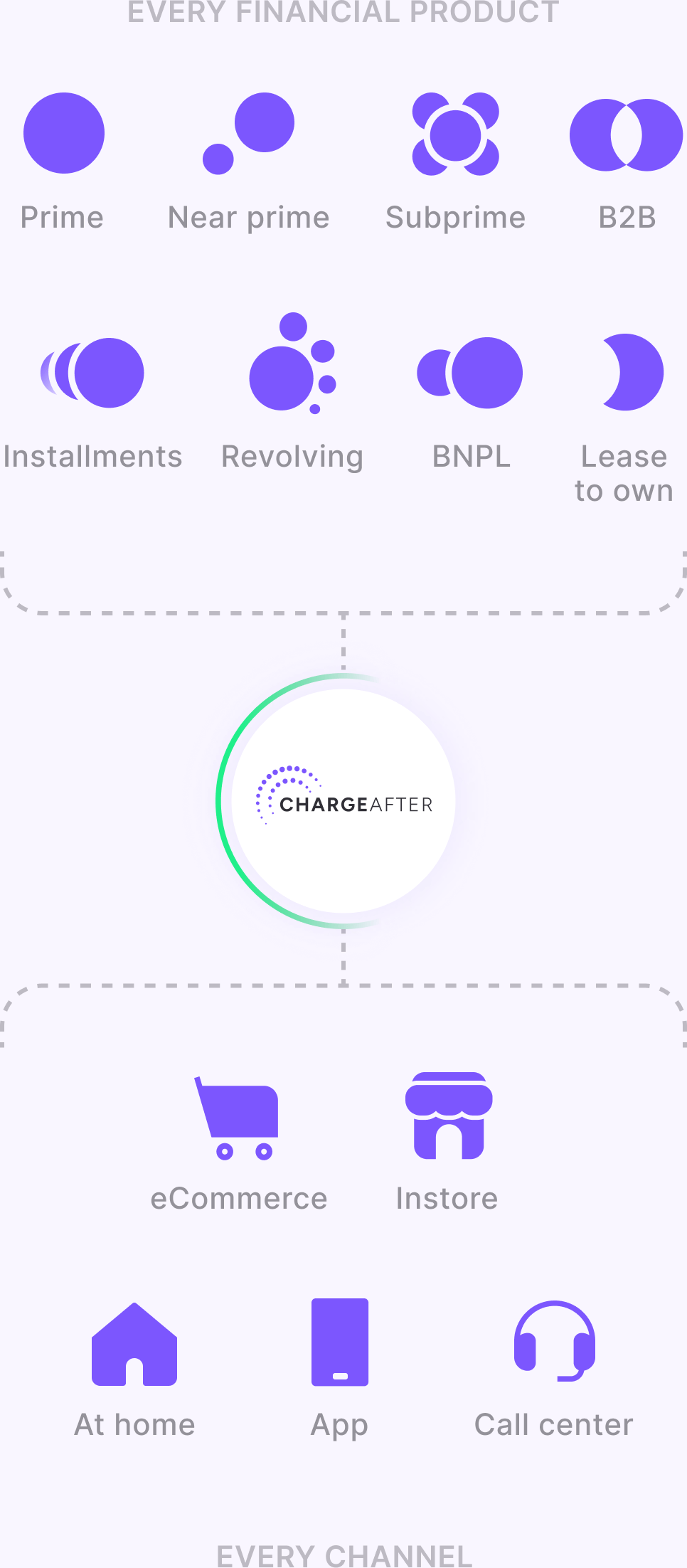

Provide your customers with personalized embedded financing choices in-store, online, or anywhere they shop. Our flexible turnkey multi-lender platform offers you the freedom to easily add any lender so you can maximize the potential of consumer financing for your brand.

Book a demo

Say goodbye to painful integrations and declined financing

A user-friendly consumer financing platform for merchants with instant access to multiple lenders and a full spectrum of financial products. Streamline your lending process and seamlessly manage the entire cycle on one unified platform.

Provide your customers with a unified omnichannel financing experience. Our state-of-the-art embedded financing platform standardizes the lending process across multiple lenders and seamlessly integrates with in-store, eCommerce, telesales, and other point-of-sale systems – for a simple loan application and approval journey.

Effortlessly integrate multiple lenders into your point of sale. Our embedded lending platform makes it easy to manage each lender’s compliance requirements, underwriting processes, and regulations. We seamlessly integrate all lenders and loan applications into a single platform.

Connect your customers to the ideal lender with our real-time matching engine. Deliver dynamic waterfall lending to maximize approvals through a wide range of financial products that span the entire consumer financing spectrum, tailored to your customers’ needs.

Managing and optimizing your customers’ lending journeys has never been easier. Our advanced back-office enables you to easily process disputes, chargebacks, and refunds. What’s more, our reporting and analytics suite gives you all the insights you need to optimize omnichannel financing programs in one place.

With a single POS financing application, your customers are matched with multiple lenders and personalized financing choices at every point of sale.

Leverage our white-label financing platform to create, manage, and distribute any consumer financing product at scale within one streamlined experience.

40

85%

3

Join merchants across the globe reporting approvals of over 80%.

We are fully secure and protected, giving you peace of mind.

Build your customer base with more approvals - they’ll remember you for it.

Optimize your financing

offers with powerful consumer

financing analytics.

Our embedded lending network accommodates any customer, regardless of their credit history or score.

Integrate any lender and consumer finance product into your embedded lending offer.

Check out the financial partners driving more approvals at your point of sale.